Business Introduction

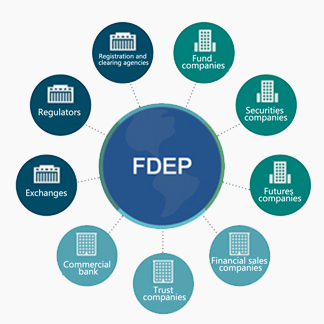

The Financial Data Exchange Platform (FDEP) uses the mature Shenzhen Securities Communication Network as the main underlying network facility. Through various access modes, FDEP makes banks, securities companies, fund companies, futures companies, exchanges, and listings.Clearing Corp, regulators and so on. The financial data exchange platform includes message transmission system and file.Transmission system. Financial Data Exchange Platform (FDEP) Financial Data Exchange and Sharing Infrastructure with securities business as its core is a one-stop data exchange solution for participants in China's capital market.

Data Exchange Platform (FDEP)

The core software of the message transmission system is a refined message middleware suitable for specific applications. Its main function is to exchange messages safely and efficiently among users of the access system, including sending and receiving messages, transmission load balancing and reliable transmission.

The system is a file transmission system suitable for non-real-time scenarios. Its main function is to send and receive files, including file compression, breakpoint continuation, priority, reliable transfer, etc.

Business Characteristics

High performance

throughput of 200,000 per second

safer

safer than direct connection and routing mode

higher availability

99.999 % availability

simpler

one development, rapid deployment online

Product introduction

Third party custody

Third party custody

Third party custodySecurities companies and banks can use FDEP to complete the transmission of real-time transfer instructions and day-end reconciliation documents between banks and securities companies.

Applicable objects: Banks and securities companies of securities margin depository

Business>

Fund sales by proxy

Fund sales by proxy

Fund sales by proxyThe FDEP provides timely and accurate data transmission services for daily purchase and redemption, dividends, reconciliation and other business data between fund companies, consignment agencies and custodian agencies, so as to realize the electronic, automatic and relevant regulatory compliance requirements of the whole process of fund business operation.

Applicable objects: Fund companies, consignment agencies and custodian agencies

Business>

Electronic reconciliation

Electronic reconciliation

Electronic reconciliationThe FDEP can realize the full electronic and automatic processing of daily asset reconciliation and fund transfer between asset management agencies and custodian agencies, improve business operation efficiency and reduce the cost and risk of labor operations.

Applicable objects: Asset management agencies and custodian agencies

Business>

Order routing

Order routing

Order routingWhen an investment institution uses multiple securities/futures trading channels to carry out securities/futures investment business, it can send trading instructions, query trading results and receive clearing data through the FDEP.

Applicable objects: Fund company, trust company, securities company, futures company

Business>

Fund direct sales

Fund direct sales

Fund direct salesFDEP can provide the interface between fund company's direct selling system and bank's payment channels, and realize the transmission of investor's payment transfer and deduction instructions in fund direct selling business.

Applicable objects: Bank and fund companies

Business>

File transfer

File transfer

File transferIt is applied to the sending and receiving of various file data between financial institutions.

Applicable objects: Users in this industry

Business>

Quotation transfer

Quotation transfer

Quotation transferSecurities companies, banks, fund companies, regional equity trading markets and other institutional customers participating in the related business of China Securities Internet System Co., Ltd can interface with the system platform of China Securities Internet System Co., Ltd through the FDEP to complete the information release, quotation, issuance and transfer of products through inter-agency non-public offering.

Applicable objects: Securities companies, banks, fund companies, regional equity markets and other institutional customers

Business>

Refinancing business

Refinancing business

Refinancing businessChina Securities Finance Corporation Limited (hereinafter referred to as CSFC) provides capital refinancing and securities refinancing (collectively referred to as refinancing services) for securities companies' capital financing and securities financing business. FDEP provides timely and accurate data transmission services for securities companies and fund companies participating in refinancing business with CSFC and China Securities Depository and Clearing Corporation Limited to help securities companies and fund companies complete refinancing business efficiently.

Applicable objects: Securities companies, fund companies

Business>

Copyright Shenzhen Securities Communication Co.,Ltd.All Rights Reserved